Key points:

-

Speculative activity across financial markets, driven largely by hedge funds and investment banks, is increasingly disconnected from the real economy and has destabilised economies all over the world.

-

A financial transaction tax can help regulate and stabilise speculative markets by disincentivising the most short-term trading, while generating additional revenues that governments can redistribute internationally to help reduce poverty or mitigate climate change in developing countries.

-

An FTT could yield around $246bn per year within the European Union, and as much as $650bn if implemented globally.

-

FTTs are technically feasible for governments to implement unilaterally or on a global scale, and there is widespread support for them from civil society and politicians, particularly within Europe.

The buying and selling of currencies, stocks, derivatives, commodities and a host of more complex financial products is a highly lucrative and rapidly expanding global industry. Despite fervent government support for banks and the financial sector across the world, it is widely accepted that some elements of these markets - if left unregulated - have the power to destabilise the global economy, push up the price of essential goods, and increase hunger and malnutrition in low-income countries.

Given their highly adverse consequences, limiting the impact of these speculative activities on domestic economies and the world's poor has long been an urgent priority for global justice campaigners. The most widely promoted method of deterring the worst kinds of speculation - a Financial Transaction Tax (FTT) - can also raise significant additional finance for poverty eradication, social protection and climate change adaptation and mitigation programs.

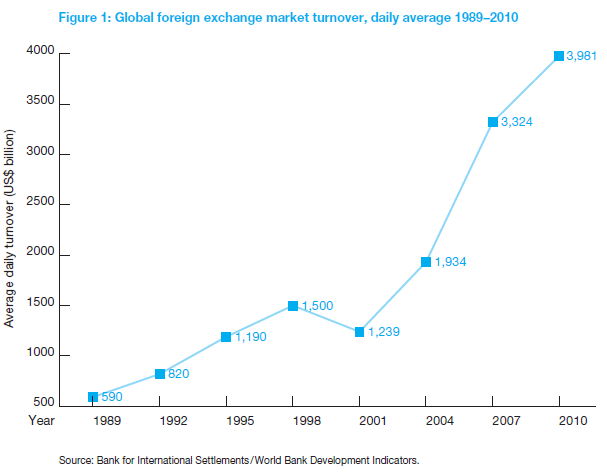

The number of speculative financial transactions that take place each day is phenomenal, particularly in relation to currency speculation which has become the largest marketplace in the world. The typical volume of foreign exchange transactions in the 1970s fluctuated between $10 and $20bn worldwide, a figure that more than tripled to $60bn by 1983.[1] By 2004, the average daily turnover in global currency markets had rocketed to almost $2tn, and it has since doubled to reach nearly $4tn a day in 2010.[2]Foreign exchange transactions now dwarf the trading volume of all other asset classes, such as bonds and stocks. The trading of commodities is also fast expanding, with the number of assets under management having already doubled since 2008 [see figure 1].[3]

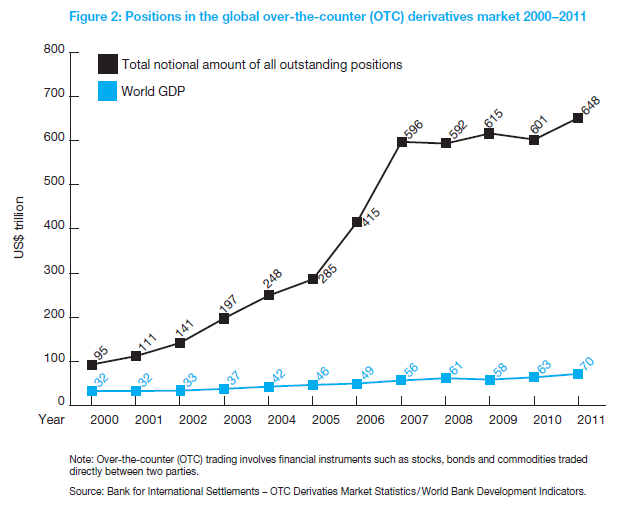

The international market for derivatives - financial securities used for risk management and high risk investments - has expanded more rapidly than any other speculative market in recent years. Derivatives are traded between banks and hedge funds or through specialised exchanges, and include ‘futures', ‘options' and the ‘credit default swaps' that were at the centre of the financial crisis of 2008. The notional value of all derivatives contracts at the end of 2011 stood at more than $648tn - a six-fold escalation over the past 10 years [see figure 2].[4]

Stock exchanges can perform many useful economic functions, such as raising capital for commercial ventures or helping farmers set the price of their future crops, and the ability to exchange currencies is essential for facilitating international trade. However, the majority of financial transactions that now take place in all these markets are highly speculative in nature, comprising complex forms of gambling using innovative, increasingly opaque and under-regulated financial products. While remaining highly profitable for a minority of wealthy individuals and corporations, this kind of speculation often bears no relationship to the ‘real' economy (concerned with actually producing goods and services) which has been relegated to a mere side-show in the money-making game popularly known as the global casino. Most traders have little interest in the product being traded other than its ability to reap them quick financial rewards.

Regulation and redistribution

With public opinion increasingly aligning against corporate excesses and unbridled greed in the financial sector, much more could now be done to regulate speculative transactions, reduce their volume and limit their negative impacts. John Maynard Keynes originally proposed taxing financial transactions in order to increase financial stability during the Great Depression of the 1930s. A number of other economists, most notably James Tobin in 1972, have since resurrected the idea and further developed it into a range of taxation options that can also raise additional tax revenue to finance poverty reduction and other urgent social or environmental programs.

In simple terms, an FTT is a very small levy placed on the trading of stocks, derivatives, currencies or other financial instruments. The tax would only apply to wholesale domestic and international financial transactions at the point of settlement, and would not directly affect transactions made by ordinary people, such as payments for goods or services.

In this way, governments can design FTTs to target the type of short-term financial speculation that has little social value but poses high risks to the economy. At the same time, the tax would be small enough for institutions to absorb comfortably. As emphasised by the International Monetary Fund (IMF), a tax on the financial sector would be ‘highly progressive', falling predominantly on the wealthy individuals who own or participate in the activities of hedge funds and investment banks.[5]

The exact amount an FTT can generate depends on the geographical breadth of the tax, the type of financial instruments targeted and the rate at which they are taxed. The impact the levy might have on the market by deterring transactions is another variable that needs to be taken into account. An authoritative estimate suggests that a broad-based tax collected globally - the option generally preferred by civil society groups as well as the United Nations - could raise as much as $650bn each year [see note].[6]According to a conservative estimate by The Task Force on Financial Integrity and Economic Development, a currency transaction tax charged on both spot and derivative foreign exchange dealing, at a rate of only one half of a basis point (one two hundredth of a percent), is likely to reduce speculative activity by 25%.[7]

The main beneficiaries of financial speculation are individual market traders driven by the prospect of making fast profits and big bonuses, as well as the hedge funds, investment banks and other companies that employ them. Together, these actors form a financial elite who reap huge profits from market volatility, while the bulk of humanity continues to struggle with the dire consequences of their excessive risk-taking such as rising food prices, job losses and economic austerity [see box 9]. A financial transactions tax (FTT) would not be enough to curb the manifold problems associated with reckless speculation, but it would represent a significant step in the right direction by throwing ‘sand in the wheels' of markets while also raising billions to tackle poverty, reverse austerity measures and address climate change.

How much revenue could be mobilised

A low-rate FTT of 0.01-0.05%, applied differentially to a wide range of transactions, could raise as much as $650bn per year if implemented globally.[8]

While universal implementation would be ideal, national or regional FTTs are also feasible. An EU-wide FTT also at a low-rate of 0.01-0.05% could raise around $246bn (€200bn) per year.[9]

An interim option is a narrower tax applied globally on foreign exchange transactions alone. This could be implemented quickly and easily at a tax rate of 0.005%, yielding around $40bn annually.[10]

Box 9: The dangers of financial speculation

In July 1944, the Bretton Woods system was put in place to fix the currencies of all countries to the US dollar, and in turn the US committed to keep its dollar convertible into gold upon request from any central bank at a fixed rate of $35 per ounce of gold. This system worked well for over two decades with high worldwide economic growth and monetary stability (the so-called golden age of capitalism) until President Nixon reneged on the convertibility promise of dollars into gold in 1971, thus inaugurating a new era of freely floating currency exchanges. This structural shift was accompanied by massive financial deregulation programs in both rich and poor countries from the 1980s, driven largely by the blind faith of Western governments in the virtues of the free market. Since then an extraordinary build-up of speculative activity has taken place throughout the world, facilitated by the computerization of trading systems. Today, speculative trading is a pastime accessible to anyone with the financial means to participate.

Currency crises

A major consequence of the growth in financial speculation is increased volatility in international currency flows. With nations increasingly dismantling their financial regulations, governments are often rendered powerless to halt the rapid flow of capital in and out of countries. This process (known as ‘capital account liberalisation') presents speculators with new markets to exploit, but with no currency controls or taxes in place to stop a speculative attack the rate of a nation's currency can suffer a severe devaluation in a very short period of time. Well-known examples of the effects of speculative attacks include the Mexican ‘peso' crisis (1994), the Asian meltdown (1997), the Russian financial crisis (1998), and the Argentine economic crisis (1999-2002). Figures show that more than 90 countries experienced a ‘severe financial crisis' between 1990 and 2001 alone, meaning that the value of the currency depreciated in a given month by at least 25%.[11] The impact of these speculative attacks can devastate economies as businesses collapse, job losses become widespread and the numbers of people living in poverty inevitably escalate.

Global financial crisis

Various kinds of speculation were also widely cited as a major cause of the global financial crisis in late 2008. With no effective oversight in place prior to the crisis, there was nothing to prevent traders creating risky financial products that were so complex that even regulators didn't fully comprehend their risks and instead awarded them inflated credit ratings.[12] While intense competition between banks led to the widespread lending of ‘sub-prime' mortgages to American home buyers, the boom in ‘innovative' financial securities such as the infamous credit default swaps (CDS) laid the ground for numerous fraudulent acts, misjudgements and finally market collapse. As the United States housing-price bubble burst, the complex financial instruments created out of homeowner debt were rendered worthless. This triggered the collapse of speculative positions across world stock markets, and many institutions that had invested heavily in these dubious securities had billions wiped off their balance sheets. Traders across the world responded to the crises by ‘short selling' (betting on a drop in the share price of the banks that held these assets), which is now pin-pointed as a major cause of the dramatic falls in the share prices of huge financial companies and banks, including Lehman Brothers.[13] According to the IMF, governments spent almost $12tn bailing out banking institutions affected by the crisis - constituting a massive socialisation of private banking losses.[14]

Food price crises

Evidence shows that excessive speculation significantly contributed to the rise in food prices that reached record levels in 2008, and again peaked in early 2011.[15] This is despite the initial insistence of financial market consultants and even policymakers who claimed the price rises reflected real changes in demand and supply, rather than the actions of powerful investors looking to profit from short-term changes in price - and who therefore capitalise on food price volatility.[16]Although this hits rich countries hard by increasing the average household food bill and forcing up overall inflation, the consequences can be life-threatening for the world's poorest people who often spend around 70 percent of their meagre budgets on food. Between 2007 and 2008, the price of cereals on world markets increased by more than 80 percent, whereas the price of maize shot up by 90 percent. As a result, forty four million people were pushed into extreme poverty by rising food prices in the last six months of 2010 alone, equivalent to almost two in every three people in the UK.[17] Even though there is enough food for everyone, many die of hunger simply because they can no longer afford to pay for it.

World leaders may profess the importance of regulating financial markets, but there is little sign yet of sufficient coordinated action being taken to prevent the continued rise in speculative activity. On the contrary, new forms of rapid computer-driven speculation (known as high frequency trading) have flourished in recent years, threatening to cause even greater havoc in markets for commodities which are central to our economies and the lives and well-being of ordinary people.[18] In the longer term, the risky behaviour and excessive speculative activity that drove the world into a financial crisis in 2008 can only be prevented through new forms of global regulation and the construction of a truly cooperative international financial framework. In the words of the United Nations Conference on Trade and Development (UNCTAD); "Nothing short of closing down the big casino will provide a lasting solution."[19]

The international campaign for a Robin Hood Tax

For decades, campaigners and civil society organisations have called for casino-style gambling on financial products to be better regulated, and for a fair share of the excessive profits from these transactions to be redistributed to fund poverty eradication or climate change mitigation. Worldwide interest in FTTs has surged since the financial crises of 2008, bolstered by the consequent growth in government debt and the widespread perception that the excesses of the financial sector were in large measure responsible for the crisis.

Whether or not the introduction of a financial transaction tax is feasible was the focus of considerable debate among economists and policymakers for many years. Concerns ranged from technical issues, such as the difficulty of implementation and the risk of evasion, to political issues such as the likelihood of a global agreement and universal application. For example, there is a delicate trade-off between the amount of additional revenue a tax could raise and the volume of trade it could eliminate; if the rate is set too high, it would reduce trading to the extent that tax revenue falls substantially.

Numerous reports by diverse advocacy groups and countries now provide ample evidence that any political and technical barriers to introducing FTTs can be overcome. The highly automated and centralised nature of the present financial system means an FTT would be hard to avoid as well as easy to collect, and the IMF has admitted it is technically feasible to implement them.[20] In fact, governments in more than 40 countries already operate various types of FTTs very effectively.[21] For example, seven countries raise around $23bn dollars each year through existing forms of FTTs, almost half of which is accounted for by stamp duties on equities in the UK and South Korea alone.[22]

Civil society leads the way

The main international body promoting FTTs is the Taskforce on International Financial Transactions and Development who released a major report on the subject in 2010.[23] Support for a global FTT now comes from a broad range of business leaders, policymakers and economists,[24] including over 1,000 Parliamentarians from over 30 countries[25] and 1,000 economists who signed an open letter to G20 ministers in April 2011 urging them to "tax City speculators to help the world's poor".[26]

While the financial lobby remains a strong opponent, there is some support for an FTT from within the banking sector.[27] FSA Chairman Lord Turner and financier George Soros have both publically backed FTTs. The French bank Crédit Coopératif has even implemented a Currency Transaction Tax (CTT) of its own accord, with all funds going towards international development.[28] There is also significant support from prominent individuals and organisations in the U.S. where Representatives Peter DeFazio and Peter Stark introduced separate Acts on the issue during the 111th Congress, and further bills are likely to be introduced during the 112th Congress.[29]

Advocacy and campaigning for an FTT by civil society is more robust than ever before. The French alter-globalisation movement ATTAC (Association for the Taxation of Financial Transactions and for Citizens' Action) originally formed in 1998 as a single-issue campaign to promote a global tax on foreign exchange transactions. More recently, The Robin Hood Tax (RHT) campaign has played a significant role in spearheading advocacy efforts in the UK and Europe with a rapid growth in support from individuals and other NGOs.[30] In 2012 a grassroots Robin Hood Tax movement also took off in the U.S., with tens of thousands of people rallying in cities across the country to tell President Obama that it's time to put ‘a tiny tax on big banks'.[31]

On the brink of an EU-wide FTT?

A key moment for the FTT campaign was at the G20 meeting in Cannes, November 2011, at which time the Vatican and other senior Church figures such as the former Archbishop of Canterbury Rowan Williams supported the implementation of an FTT as one of a number of radical reforms to the global financial system.[32] The Microsoft founder Bill Gates also threw his weight behind European efforts to introduce a small tax on financial trades in a report to world leaders, which he believes could initially work on a regional basis, such as between G20 members or European countries, and would not depend on universal adoption before being implemented.[33]

On 28th September 2011, the president of the European commission, José Manuel Barroso, announced that Brussels had adopted the idea of an FTT following backing from Germany, France and a number of other European countries. Under Barroso's proposals, a minimum tax rate on the trading of bonds and shares would be set at 0.1% and at 0.01% for derivative products (levied on trades where at least one of the institutions is based in the EU), which could raise $78bn a year (€57bn).

Although tax changes at an EU level must be supported by all 27 member states and many governments remain staunchly opposed to the proposals (particularly the UK), there is increasing hope for an FTT to be tried in the 17 countries that make up the eurozone. Four of Europe's five biggest economies - France, Germany, Spain and Italy - are committed to setting up an FTT in Europe, along with a ‘coalition of the willing' of other member states. Germany remains the driving force behind an FTT being agreed among EU nations, despite progress moving in fits and starts owing to the euro debt crisis. Even the U.S. is beginning to shift position, with Obama expressing a neutral stance on the EU proposal alongside growing support for the general concept in the halls of Congress. On 1st August 2012, President Hollande in France took the lead by introducing the first unilateral FTT in Europe at a rate of 0.2% - double the rate proposed by former French President Sarkozy - with promises that some of the revenue will be allocated to development.[34]

This is a campaign that civil society can feasibly win. But with significant opposition to the tax remaining from those within the financial industry and many politicians across North America and Europe, it is imperative that campaigners persist in their united demands for an FTT to be implemented globally. The tax should be set at a rate high enough to reduce the global volume of speculative trade significantly, and applied broadly in order to cover the full spectrum of speculative transactions. Most importantly, it is imperative for civil society to ramp up pressure on governments to use the revenues generated to fight poverty and climate change.

Learn more and get involved

An Idea Whose Time Has Come: Adopt a Financial Transactions Tax: A briefing paper by John Dillon for Kairos, May 2010, that overviews the current debate around an FTT in its historical context, and explores the growing political momentum in its favour. <www.kairoscanada.org>

Currency Transaction Taxes: Articles and resources compiled by Global Policy Forum based at the United Nations headquarters in New York. <www.globalpolicy.org/social-and-economic-policy>

Financial Transactions Taxes and the Global South - Frequently Asked Questions: A factsheet by the Institute for Policy Studies the positive outcomes that these taxes will generate for developing countries. <www.ips-dc.org>

Financial Transactions Tax Now! A campaign for a European Financial Transaction Tax. <www.financialtransactiontax.eu/en>

Regulate Global Finance Now! A coalition of progressive forces called Europeans for Financial Reform that have come together to spearhead a campaign for real reform in our banking and financial system. <europeansforfinancialreform.org>

The Robin Hood Tax campaign: Part of a movement of campaigns in more than 25 countries committed to reducing poverty and tackling climate change by taxing financial transactions. <www.robinhoodtax.org>

The Robin Hood Tax: the Time is Now: Oxfam media briefing published in June 2011 on why a Financial Transactions Tax (FTT) is morally right, politically attractive and technically feasible - and how it could raise billions to fight poverty and climate change. <www.oxfam.org>

Short film on "Food speculation": A short film by World Economy, Ecology and Development (WEED) that describes how food speculation works, what the dangers are, and what needs to be done. <www.weed-online.org/themen/english/5021520.html>

The Taskforce on International Financial Transactions and Development: The main international body promoting FTTs, formed by the Leading Group on Innovative Financing for Development - a global platform made up of 55 member countries operating alongside international organisations and NGOs. <www.leadinggroup.org/rubrique113.html>

World Parliamentarians Call for Tobin Tax: A list of Members of Parliament in 33 countries who support a financial transactions tax. <tobintaxcall.free.fr/list.htm>

Notes:

[1] Bernard Lietaer, The Future of Money: Creating New Wealth, Work and a Wiser World, Century, 2001, p. 312.

[2] Bank for International Settlements, Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2010 - Final results, December 2010.

[3] TheCityUK, Commodities Trading 2011, March 2011, p. 1.

[4] Bank of International Settlements, Semiannual OTC derivatives statistics at end-December 2011, June 2012.

[5] Owen Tudor, 'IMF admits Robin Hood Tax is possible: major step forward for campaign', TouchStone blog, 19th October 2010.

[6] Note that estimates vary widely of how much annual revenue could be generated from a financial transactions tax applied globally. This estimate is taken from the European Parliament resolution of 8 March 2011 on innovative financing at global and European level, INI/2010/2105, Note 14, which was calculated using: Stephan Schulmeister, Margit Schratzenstaller and Oliver Picek, A General Financial Transaction Tax: Motives, Revenues, Feasibility and Effects, Austrian Institute of Economic Research (WIFO), March 2008. Another authoritative figure has been presented by the Task Force on Financial Integrity and Economic Development et al (see Taxing Banks: A joint submission to the International Monetary Fund, February 2010, p. 40) who estimate revenues of $376bn annually. Oxfam estimate that approximately $400bn could be raised from a broad and globally applied tax (see Oxfam, The Robin Hood Tax: the Time is Now, June 2011). The Economic Commission for Latin America and the Caribbean (ECLAC) estimate that an FTT charged at a rate of 0.05% and applied globally has the potential to raise $661bn per year, equivalent to 1.21% of world GDP (see ECLAC, ‘Global tax on financial transactions is a priority for the stability and development', press release, 24th August 2011.)

[7] Task Force on Financial Integrity and Economic Development et al, Taxing Banks: A joint submission to the International Monetary Fund, February 2010.

[8] See reference 6 for calculation.

[9] The estimate of €200bn per year was quoted by the European Parliament, see the resolution of 8 March 2011 on innovative financing at global and European level, INI/2010/2105, Note 14, which was calculated using: Stephan Schulmeister, Margit Schratzenstaller and Oliver Picek, op cit. Currencies have been converted as per exchange rates on 2nd August 2012 (1 EUR = 1.22791 USD).

[10] United Nations Development Programme, Human Development Report 2011: Sustainability and Equity - A Better Future for All, Palgrave Macmillan, New York, November 2011, p. 95.

[11] Susan George, Down the Great Financial Drain: How debt and the Washington Consensus destroy development and create poverty, Society for International Development, 2007, <www.sidint.org/development>

[12] See Carl Levin and Tom Coburn, Wall Street and the Financial Crisis: Anatomy of a Financial Collapse, Permanent Subcommittee on Investigations, United States Senate, 13th April 2011.

[13] Martin Khor, ‘Finance: Speculation via short selling blamed for financial turmoil', Third World Network, SUNS no. 6552, 25th September 2008.

[14] Edmund Conway, ‘IMF puts total cost of crisis at £7.1tn', The Telegraph, 8th August 2009.

[15] Olivier De Schutter, Food Commodities Speculation and Food Price Crises. Regulation to reduce the risks of price volatility, Briefing note by the Special Rapporteur on the right to food, September 2010.

[16] Jayati Ghosh, ‘Chasing Volatility', Frontline, 29th August 2008.

[17] World Bank, ‘Food Price Hike Drives 44 Million People into Poverty', press release, 15th February 2011.

[18] Richard Gower, Financial Crisis 2: The Rise of the Machines, Oxfam, August 2011.

[19] United Nations Conference on Trade and Development, The Global Economic Crisis: Systemic Failures and Multilateral Remedies, Report by the UNCTAD Secretariat Task Force on Systemic Issues and Economic Cooperation, March 2009.

[20] Stijn Claessens, Michael Keen, Ceyla Pazarbasioglu, Financial Sector Taxation: The IMF's Report to the G-20 and Background Material, International Monetary Fund, September 2010. See also a recent IMF working paper, but note that this does not necessarily express the views of the IMF; John D. Brondolo, Taxing Financial Transactions: An Assessment of Administrative Feasibility, IMF Working Paper, WP/11/185, Fiscal Affairs Dept, August 2011.

[21] D. Beitler, Raising Revenue: a Review of Financial Transaction Taxes Throughout the World, Just Economics: London, 2010.

[22] Avinash Persaud, How can we implement today a Multilateral and Multi-jurisdictional Tax on Financial Transactions?, Leading Group on Innovative Financing for Development, October 2011, p. 5.

[23] Report of the Committee of Experts to the Taskforce on International Financial Transactions and Development, op cit.

[24] Centre for Economic and Policy Research (cepr), Support for a Financial Transactions Tax, February 2011.

[25] The Robin Hood Tax, ‘Parliamentary Declaration FTT - Breakdown of Country Totals', 31st October 2011.

[26] The Robin Hood Tax Campaign, ‘1,000 Economists Tell G20: Support a Robin Hood Tax', 13th April 2011.

[27] Corporate Europe Observatory, Lobbying to kill off Robin Hood, March 2012.

[28] Stamp Out Poverty, ‘French bank breaks rank and implements own currency tax', accessed October 2011, <www.stampoutpoverty.org>

[29] Centre for Economic and Policy Research, ‘Facts and Myths about a Financial Speculation Tax', December 2010.

[30] The Robin Hood Tax, Who's Behind it?, <www.robinhoodtax.org>

[31] Janet Redman, ‘A Robin Hood Tax Can Raise Big Bucks for People and the Planet', Institute of Policy Studies, 19th June 2012.

[32] Pontifical Council for Justice and Peace, Towards Reforming the International Financial and Monetary Systems in the Context of Global Public Authority, Vatican City, 2011, < www.democraciaparticipativa.net>; Rowan Williams, ‘Time for us to challenge the idols of high finance', Financial Times, 1st November 2011.

[33] Bill Gates, Innovation with Impact: Financing 21st Century Development, A report by Bill Gates to G20 leaders, Cannes Summit, November 2011.