Key points:

- Although the IMF is in need of fundamental reform to its governance, policies and mandate, it is uniquely placed to leverage its significant financial resources for climate finance and poverty eradication in developing countries.

- There is a strong case for the IMF’s Special Drawing Rights facility to be expanded as a cheap and quick source of public finance for low-income and developing countries.

- The IMF has the third largest holding of gold reserves in the world, which could be progressively sold off at market rates without impacting international gold prices or the IMF’s ability to lend.

- By using a combination of these options, it would be possible to raise a one-off $165bn by transferring existing SDRs, a further $100bn every year from new SDR allocations, and an additional 15.5bn annually if IMF gold reserves were progressively sold over a period of ten years.

- These proposals for sharing the IMF’s assets could help restore its flagging legitimacy and compensate for its decades of international financial mismanagement, as well as pave the way for deeper reforms to the Fund and the global economic architecture.

The powerful influence exerted by the International Monetary Fund (IMF) over economic policy decisions taken in countries all over the world has earned it a deeply controversial reputation in recent decades. While Wall Street and the world of globalised finance continues to rely on the IMF to try and uphold a global economy based on free markets, civil society groups and millions of citizens throughout the Global South see the Fund and its market-driven policies as a threat to social and economic justice. Many observers have argued that the IMF's programmes and policy prescriptions are harmful to developing countries and ineffective at producing economic stability [see box], leading many campaigners to call for the Fund to be fundamentally restructured or entirely decommissioned.

Even without enacting much-needed reforms to the IMF's governance, policies and mandate, the institution remains uniquely placed to leverage its significant resources to raise and redistribute vast quantities of additional finance by utilising its Special Drawing Rights facility, and through the progressive sale of its enormous reserves of gold bullion. These measures alone could raise billions of dollars over a number of years to help finance poverty eradication and climate change adaptation and mitigation programs in developing countries. Implementing these redistributive mechanisms on a global scale requires little more than goodwill and some degree of international cooperation, as well as the necessary political resolve to use the IMF's resources more effectively during a time of economic upheaval.

Making better use of Special Drawing Rights

One of the primary roles of the IMF is to ensure that countries have sufficient reserves to sustain their international financial transactions. While this is usually achieved by lending money to governments experiencing balance of payment problems (such as when a country's payments for imports exceeds the income it receives for its exports), the Fund can also utilise Special Drawing Rights (SDRs) for the same purpose.

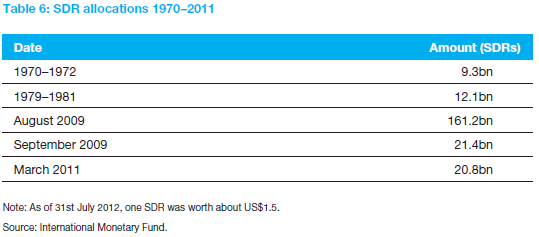

SDRs were first introduced as a supplementary international reserve asset in 1969, at a time when global trade and finance was rapidly expanding but there was a shortage of both dollars and gold. SDRs are used much less frequently today since the collapse of the fixed exchange rate system in 1971, which eliminated the dollar-gold linkage and made the US dollar the de facto international reserve currency. As they were no longer a crucial supplement to the Bretton Woods system, SDR's fell into abeyance after a final allocation was made in 1981. However, at the G-20 Summit in April 2009 world leaders called for the first allocation of SDRs in 28 years in a bid to inject liquidity into the crisis-ridden global economy. Within five months, the IMF made a general allocation of SDRs worth approximately US$250bn. Wealthy countries received roughly two-thirds of this amount, and less than five percent - about $11bn - went to the most vulnerable countries in sub-Saharan Africa [see table 6].[1]

There is no material cost in creating SDRs and, in contrast to its loan financing, the IMF cannot dictate the conditions under which they are used. The Fund can only allocate SDRs in proportion to a member country's quotas, which are determined by the country's relative weight in the global economy. Because of this, most of the SDRs go to wealthy nations with the biggest quotas and most voting power at the IMF. When a government converts its SDRs into hard currency, it is required to pay a small interest charge to the IMF applicable until that government converts the currency back into the form of SDRs.

Despite existing concerns over the insufficient allocation of SDRs to poorer countries, there is a strong case for the scope and use of SDRs to be expanded as an innovative source of development funding. SDRs could provide a convenient, quick and cheap source of public finance for low-income and developing countries, and if utilised fairly and responsibly they could raise significant sums for critical financing needs such as poverty eradication, climate finance and effective measures to counter the impacts of the global economic crisis.

Three ways to redistribute SDRs

There are three main proposals for how SDRs could be put to better use. The first is for developed countries to transfer a portion of their idle SDR allocation to countries that need them. Wealthy countries received approximately US$165bn of the general allocation of SDRs made in 2009. If this allocation was transferred to developing countries on the basis of need, it would improve the credit ratings of recipient countries and enable them to acquire loans on better terms. Alternatively, they could convert the SDRs to hard currency with no conditions attached. The interest charges on the converted SDRs could be covered either by the donor countries, or through the sale of IMF gold stocks.[2]

A second proposal was originally put forward by the financier George Soros at the Copenhagen Climate Change Conference, December 2009. He suggested that wealthy countries should utilise a portion of their existing SDR allocations to finance a $100bn "fast-start green fund" - preferably under the auspices of the United Nations. The green fund would use the SDRs to back bonds which would then be offered on international capital markets. The proceeds from the sale of these bonds could then form the basis of much-needed climate loans to developing countries, which they could use for adaptation, mitigation and other environmental projects.[3]

A more far-reaching proposal put forward by civil society organisations is for the IMF to issue new SDRs either annually or automatically during times of financial crisis. These new allocations could occur in addition to SDR transfers and would be apportioned on the basis of need rather than by quota. Needs could be determined by identifying a country's financing gap for meeting its goals on delivering healthcare, housing, education, and food security. It is widely acknowledged that new allocations of approximately $100bn a year could be made without leading to inflation.[4] A group of leading economists have also suggested that annual SDR allocations equivalent to US$240-400bn over a three year period would help stabilise the global economy.[5]

Selling the IMF's gold stocks

The IMF has the third largest holding of gold reserves in the world after the United States and Germany, valued at 90.5 million ounces - almost 2,600 metric tonnes.[6] These gold holdings have been acquired over time through several types of transactions. Initially, 25% of member states' quota subscriptions and subsequent quota increases were paid in gold. The majority of the IMF's gold was acquired prior to 1978, when member's payments of loan interest charges were also mostly paid in gold, and the currency of a member country could be acquired by another member through the sale of gold to IMF. Furthermore, member countries could use gold to repay the IMF for credit previously extended.

Following the Second Amendment of the IMF's Articles of Agreement in 1978, the use of gold was no longer obligatory in transactions between the IMF and its member countries. Under the amended Articles, the IMF was permitted to sell gold outright on the basis of prevailing market prices. It could also accept gold in the discharge of a member country's loan repayments at an agreed price (based on market prices at the time of acceptance).

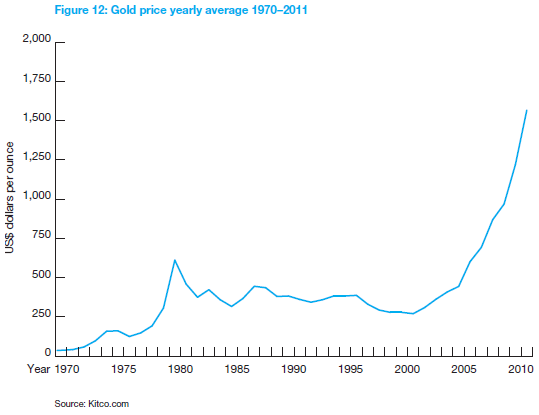

The value of the IMF's gold is recorded on its balance sheet on the basis of ‘historical cost' which stands at only $4.9bn dollars. But given the current commodity price of gold its market value is substantially more, amounting to over $160.1bn as of the end of March 2012[7] - a figure that is expected to continue rising over coming years [see figure 12].[8]

As widely argued, these reserves could be put to far better use if they were systematically sold-off at market rates over a number of years.[9] The additional $155.2bn that would be raised by selling the gold could be used by the IMF to provide multilateral debt relief for countries struggling to repay unsustainable and unjust debts, without reducing the historic book value of the Fund's reserves [see note].[10] Alternatively, it could provide condition-free grants to countries in urgent need of finance for climate change mitigation and adaptation or social protection programs.

Using the gold reserves in any of these ways would not affect the IMF's day-to-day lending activities, as the gold only constitutes a tiny proportion of its total asset base.[11] But it would represent an important redistribution of international financial resources in favour of countries with very low incomes and high rates of poverty, and those already experiencing the devastating impacts of climate change.

How much revenue could be mobilised?

By using a combination of the options below, it would be possible to raise a one-off $165bn by transferring existing SDRs, and a combined annual sum of $115.5bn per year from new SDR allocations and progressive gold sales:

Transferring SDR allocations: $165bn (one-off).[12]

New SDR allocations: $100bn (annually).[13]

IMF gold sales: $155.2bn (for example, $15.5bn annually for 10 years - see note).[14]

Box 15: International Monetary Failure

The IMF was created at the Bretton Woods Conference of 1944 to help maintain global financial stability and economic cooperation in the aftermath of the Second World War. Since then, the Fund's mandate has changed considerably and it is often referred to as the world's ‘lender of last resort' for its role in providing loans to cash-strapped developing countries. Following the breakdown of the Bretton Woods exchange rate system in the 1970s, its mission has significantly expanded to include development finance and policy alongside its sister organisation, the World Bank. In promoting rapid trade liberalisation and financial deregulation in developing countries, it also shares an ideological approach to global economic governance with the World Trade Organisation. Together with a powerful body of economists and policy-makers based mainly in the Global North, these three organisations are largely responsible for setting the rules of economic globalisation and ensuring that all countries adopt identical visions, policies and standards for their growth and development.[15]

One of the main functions of the IMF in recent decades has been to manage and resolve financial crises in emerging markets, yet its track record in delivering this goal leaves much to be desired. During the period of its emergency lending, the Fund has overseen massive gyrations in the exchange rate of major currencies, growing trade imbalances, and recurrent debt and financial crises that have often reverberated across the global economy. Many analysts have accused the Fund of instigating these crises rather than helping governments to avoid them, largely as a result of its blind faith in markets and consequent pressure on countries to abandon the regulation of cross-border trade and financial flows.[16] The IMF has also consistently failed to predict these crises and issue early warnings, not least with the Mexican peso crisis in 1994, the Asian financial meltdown of 1997 and the sub-prime turmoil of 2007/8. Furthermore, several countries working under IMF programs and drawing on its resources have experienced severe instability and even sovereign default, as in the cases of Russia, Argentina and now possibly Greece. In many instances, at the IMF's insistence, uncollectible private debts are converted into public debt.

One size fits all

In return for financial assistance from the IMF, borrower countries must implement a set of sweeping structural reforms to the economy. Such conditions attached to IMF loans have often forced countries to liberalise and deregulate their trade, investment and financial sectors, as well as privatise formerly state-owned industries among other market-oriented reforms. This ideologically-driven set of policies, once known as the ‘Washington Consensus', were most notoriously expressed in Structural Adjustment Programs (SAPs) imposed by the IMF and World Bank on close to 90 developing countries from the mid-1980s to the 1990s. Much of the criticism of the IMF in the past has focused on the adverse repercussions of structural adjustment for economic growth and poverty, with many of the IMF packages being associated with massive job losses and drastically reduced investments in health, education and other public services.[17]

IMF programs are also held under fire for interfering with the proper jurisdiction of a sovereign government, and leaving little room for manoeuvre to national policymakers. Although structural adjustment programmes were officially replaced by a new Poverty Reduction and Growth Facility (PRGF) in 1999 with the aim of making "poverty reduction efforts among low-income members a key and more explicit element of a renewed growth-oriented economic strategy",[18] many civil society organisations have since questioned the IMF's new rhetoric on ‘country ownership' of policies and ‘participation' in the development process.[19] Despite a number of initiatives that the IMF has taken to inform its use of structural conditionality, studies reveal that it continues to push privatisation, liberalisation and other highly sensitive economic reforms on poor countries. This is often despite widespread grassroots opposition, and regardless of the constraint these policies may impose on a government's ability to invest in much-needed basic services.[20]

In a long history of debate over the IMF's decision-making power, the institution's legitimacy is frequently questioned in relation to its unbalanced governance structure. This includes the selection of the IMF's Managing Director which, under the terms of an unwritten agreement at the time of the IMF's founding, has always gone to someone from Western Europe (while the World Bank president has always been a US citizen) despite widespread criticism from developing countries. European countries continue to dominate the IMF's executive board, holding 9 out of the 24 seats that are supposed to represent 187 member countries.[21] The distribution of voting rights is also heavily skewed towards the major industrialised countries through the ‘one dollar equals one vote' rule, and the United States - which retains the largest share of votes at around 17 percent - is effectively given the sole privilege of veto in matters such as adjustment of quotas, the sale of IMF gold reserves and allocation of Special Drawing Rights. In effect, IMF packages shift macro-economic decision-making from national governments to a Washington-based financial institution in which most developing countries hold little voting power. Although a longstanding reform process has sought to address the IMF's democratic deficit,[22] many observers in the South continue to view the Fund as an instrument for the Western powers to impose self-serving policies on the rest of the world.[23]

The track record and relevance of the IMF was increasingly questioned during the tenure of Rodrigo de Rato as its managing director between 2004-2007. Many of its top borrowers repaid the IMF early to reduce interest payments and free themselves from the Fund's policy ‘advice', most notably two of its biggest debtors - Brazil and Argentina - which joined other Latin American countries in trying to carve out an autonomous alternative to the World Bank and IMF-dominated international financial architecture.[24] Just when the IMF's future was looking most endangered, however, the bursting of the US housing bubble (unforewarned by the Fund, despite overwhelming evidence) gave it a new lease of life in the midst of economic turmoil. The G20 played a decisive part in attempting to restore the IMF's legitimacy by trebling the resources available to the institution to $750bn, thereby enabling it to make loans to many more countries and at greater amounts in attempts to combat the global financial crisis.[25]

The return of economic austerity

As the IMF strengthens its influence in both emerging economies as well as debt-laden countries in Europe, there appears to be little change to its traditional policy advice and conditions. The descent of Greece into a sovereign debt crisis marked the first time that a country using the euro had resorted to an IMF bail-out, resulting in a devastating austerity package and massive public unrest.[26] New IMF programmes for Ireland and Portugal soon after highlighted the same heavy conditionality attached to loans with austerity at the heart of the Fund's debt sustainability policies.[27] Recent IMF programmes in low-income countries such as El Salvador, Ethiopia and Latvia are also heavily criticised by civil society for inflicting conditions that constrain governments' ability to prioritise basic social and economic rights, and for providing macroeconomic policy advice that remains insensitive to the needs of developing economies.[28]

The austerity measures now being imposed by the IMF in several European countries closely parallel the structural adjustment policies that were implemented across Latin America, Africa and Asia at the height of the Fund's power during the 1980s and 1990s. As a standard response to financial crises over the past 30 years, the IMF typically bails out foreign banks to prevent a country from defaulting on its debts, then imposes harsh cuts in government expenditure and extensive programmes of privatisation, liberalisation and deregulation in order to prioritise loan repayments.[29] This is regardless of the devastating social impacts that austerity measures cause, and the historical evidence that the IMF's structural adjustment policies can deepen economic recessions and fail to spur recovery.[30]

The IMF's continued alignment with the interests of the US Treasury and the world's banking and finance sector has led to various calls from leading activists and civil society organisations for it to be decommissioned or radically transformed.[31] In more than 60 years since the Fund was created it has strayed so far from its original mandate that it has even failed to help countries manage economic crises and keep their international accounts in order, leading to global imbalances, widespread recessions and increasing inequality. So long as the IMF's governance is determined by the handful of developed nations that provide most of its funding, it remains unlikely that it can be reformed into a truly multilateral institution responsible for international economic stability with equal rights and obligations provided to all its members. Whether the IMF is extensively restructured or entirely replaced, it is clear that a more inclusive and representative organisation would be better positioned to maintain global financial stability and provide financial assistance to countries without attaching punitive policy conditions that disproportionately affect the poor.

Will the IMF share its assets?

In response to the global financial crisis of 2008, governments began considering a number of policy options long dismissed by national and international policymakers. This included a call by the G20 group of countries for a general allocation of SDRs in order to provide liquidity to the global economic system by supplementing the IMF's member countries' foreign exchange reserves - a move that was quickly and decisively acted upon.[32]

With this precedent and the new resolve demonstrated by the G20, an expanded role for SDRs as a source of development finance is gaining political support. At the United Nations Conference on the World Financial and Economic Crisis and Its Impact on Development in June 2010, the G77-plus-China group of developing countries united behind a call for a significant expansion of SDR allocations to meet development financing gaps. While the conference's final statement did not reflect their position, it did call for a "review [of] the allocation of special drawing rights for development purposes".[33]

The work of the Stiglitz Commission, convened by the President of the UN General Assembly to investigate the international monetary and financial system, likewise articulated significant support for expanding the scope of SDRs.[34] The commission recommended annual allocations of new SDRs as an equitable path to establishing a new global reserve system with distribution determined not only by economic size, but also on the basis of need. Civil society has echoed these calls for allocation criteria to be based on development indicators such as relative poverty levels, or more specific macroeconomic factors such as shortfalls in a country's foreign exchange reserve levels.[35]

Targeted allocations for development or climate finance purposes would require an amendment to the IMF's Articles of Agreement, which can be a lengthy process. But the process that started with the G20 calling for the $250bn SDR allocation in 2009 took only four-and-a-half months to result in an allocation. This indicates that an expanded role for SDRs is eminently possible if there is a sufficient degree of political will.

Unlike the proposal for targeted SDR allocations, a precedent for SDR transfers for development financing already exists. In August 2009, the IMF floated a proposal for wealthy countries to transfer their idle SDR allocation to the IMF itself, which would then loan the resources to low-income countries at concessional rates. Both the British and French governments agreed, although the SDRs had to be first converted into hard currency. While this arrangement is not ideal as the IMF loans will carry their usual harmful conditions, it has at least set a precedent for using SDR-generated resources for development funding.[36]

Sharing the IMF's gold

The IMF's Articles of Agreement place strict limits on the use of their gold reserves, and the Fund is particularly concerned about the destabilising impact that selling their gold could have on the international market price of the commodity. Consequently, the sale of gold by the Fund requires an 85% majority vote from the Board - the same majority required to amend the IMF's Articles. Although this may seem like a significant hurdle, the recent gold sale approved as part of the Fund's recent drive to find robust new income sources to finance its activities shows that it is politically feasible.[37]

On 18th September 2009 the Executive Board approved the sale of one-eighth of the Fund's total holdings of gold at that time - approximately 403 metric tons. By working in cooperation with the world's central banks - as per the Central Bank Gold Agreement (CBGA) - the IMF sold the reserves in a phased manner that didn't disrupt the gold market (completed in late December 2010).[38]

The sale generated $14.7bn, most of which is being used to fund its ongoing activities and subsidise its low interest lending. Because of rising gold prices at the time, however, the sales also generated an excess windfall profit of $2.8bn. Many civil society organisations demanded that the IMF uses these funds to cancel the debts of low-income countries facing financial hardship outside of their control.[39]

In February 2012, the Board of the IMF finally agreed to release $1.1bn of windfall profits from selling gold at a high price to be spent on subsiding concessional loans for low-income countries. How to use the rest of its windfall - another $1.6bn - is still up for discussion.[40] However, because this money is seen as IMF general resources, it must first be released back to member states in proportion to their quotas, and then recycled back to an IMF fund (called the Poverty Reduction and Growth Trust). The Third World Network expressed that it is unfortunate that the IMF cannot revise its rules for the use of its gold sale proceeds in a way that would directly benefit low-income countries, such as through debt cancellation.[41]

Even before the financial crisis, civil society groups have been calling for the sale of IMF gold for human development purposes. Various reports published by campaign organisations have outlined programs for the phased sale of all the IMF's gold stocks, within the framework of the CBGA, to fund multilateral debt relief and provide condition-free development grants.[42] These recommendations emphasise that the phased and transparent sale of IMF gold stocks over a minimum period of 10 years would not negatively impact the market or affect the IMF's ability to lend.

Together, these modest proposals for redistributing the IMF's assets through SDR allocations and gold sales would go a long way towards helping developing countries cope with their massive budget shortfalls. The economic downturn has proven a huge boon for the institution despite the role it played in cheerleading financial deregulation and helping to precipitate the recent financial crisis. As a first step towards compensating for decades of global financial mismanagement, the IMF should immediately free up its excess resources to help address urgent poverty eradication and climate financing needs. Although the Fund needs to fundamentally rethink its role and reorient its activities, these interim measures could help restore its flagging legitimacy and prepare the way for more substantial reforms to the global economic architecture in the longer term.

Learn more and get involved

Alternatives to Economic Globalization: An invaluable civil society resource on the need for new international structures, published by the International Forum on Globalisation in 2004.

Bretton Woods Project: A UK-based organisation focusing on the World Bank and IMF to challenge their power, open policy space, and promote alternative approaches. <www.brettonwoodsproject.org>

Focus on the Global South: See the campaign on ‘deglobalisation' for new ideas on global economic reform, including the articles and books by Walden Bello. <www.focusweb.org>

Globalization and Its Discontents: The now classic book by Joseph E. Stiglitz on the need for major reform at the IMF and World Bank, published by W.W. Norton, 2003.

IMF Gold Campaign: A coalition of international partners demanding that the extra profit derived from IMF gold sales go to the world's poorest countries for debt relief. By the Jubilee USA Network and 58 international partners. <www.jubileeusa.org>

One size for all: A study of IMF and World Bank Poverty Reduction Strategies: Briefing paper by the World Development Movement, September 2005. <www.wdm.org.uk>

Reforming the International Financial System for Development: Edited by Jomo Kwame Sundaram, a volume of essays that analyse the systemic flaws in the global economic system, with key chapters on special drawing rights. Published by Colombia University Press, 2011.

South Centre: See the programme on global governance for development for the many reports and recommendations on reforming international financial institutions. <www.southcentre.org>

Transnational Institute: An international network of scholar activists aiming to provide intellectual support to worldwide social movements, with extensive research on global economic justice and international finance. <www.tni.org>

10 Reasons to Abolish the IMF & World Bank: A book for campaigners by Kevin Danaher and with a foreword by Anuradha Mittal, published by Seven Stories Press, 2nd Edition: 2004.

Notes:

[1] Soren Ambrose and Bhumika Muchhala, Fruits of the Crisis: Leveraging the Financial & Economic Crisis of 2008-2009 to Secure New Resources for Development and Reform the Global Reserve System, ActionAid International and Third World Network, January 2010, p. 4.

[2] ActionAid USA, ‘What Are Special Drawing Rights and How Can They Be Used to Finance Climate Adaptation and Mitigation?', June 2010.

[3] George Soros, "Using SDRs to Fight Climate Change," speech at Copenhagen Climate Conference, December 2009. See Andrew C. Revkin, Soros Hatches Climate Finance Scheme, The New York Times, 10th December 2009; Nancy Birdsall and Benjamin Leo, ‘Find Me the Money: Financing Climate and Other Global Public Goods', Center for Global Development, Working Paper 248, April 2011.

[4] Soren Ambrose and Bhumika Muchhala, op cit; ActionAid USA, What are Special Drawing Rights...?, op cit; Yılmaz Akyüz, Why the IMF and the international monetary system need more than cosmetic reform, The South Centre, Research Paper 32, November 2010.

[5] Joseph E. Stiglitz et al, ‘A Modest Proposal for the G-20', Project Syndicate, 1st April 2011.

[6] International Monetary Fund, ‘Fact Sheet: Gold In the IMF', updated 30th March 2012.

[7] Ibid.

[8] Standard Chartered Bank, In gold we trust: A definitive study of gold mine production from 2011 to 2015, 14th June 2011.

[9] For example, see: Jubilee USA, IMF Should Use Excess Windfall Profits from Gold Sales to Cancel Debt for Poor Countries in Crisis, Background Paper on a Civil Society Proposal, January 2011; Eurodad, CIDSE, AFRODAD, Jubilee USA and the Halifax Initiative, ‘Sell IMF gold to cancel the debt: decision time is now', 13th April 2005; Sony Kapoor, ‘Mobilizing IMF Gold for Multilateral Debt Cancellation', Development, 48(1), 2005, pp. 92-100; Jonathan E. Sanford, ‘IMF Gold and the World Bank's Unfunded HIPC Deficit', Development Policy Review, 2004, 22(1): 31-40.

[10] Note: this figure is calculated using the current market value of the IMF's gold at $160.1 billion, minus its historical cost which stands at $4.9 billion. See: International Monetary Fund, ‘Fact Sheet: Gold In the IMF', updated 30th March 2012.

[11] Sony Kapoor, ‘Paying for 100% Multilateral Debt Cancellation', Eurodad, January 2005, p. 12.

[12] ActionAid USA, What are Special Drawing Rights?, op cit; Soren Ambrose and Bhumika Muchhala, op cit.

[13] Ibid. See also: Yılmaz Akyüz, Why the IMF and the international monetary system need more than cosmetic reform, op cit.

[14] Note: To mitigate any negative impacts that selling the IMF's gold reserves might have on the international price of gold, the reserves would need to be sold progressively and in a predictable and transparent manner over a period of 10-20 years. See Sony Kapoor, Paying for 100% Multilateral Debt Cancellation, op cit., p. 11.

[15] John Cavanagh and Jerry Manders (eds), Alternatives to Economic Globalization, International Forum on Globalization, Berret-Koehler, 2004, chapter 3.

[16] For example, Walden Bello of Focus on the Global South and Martin Khor at the South Centre have each documented the negative consequences of IMF policies and programmes in the South. See also Peter Chowla, ‘Time for a new consensus: Regulating financial flows for stability and development', Bretton Woods Project, December 2011.

[17] Frances Stewart, Adjustment and Poverty: Options and Choices, Routledge, New York, 1995.

[18] International Monetary Fund, The Poverty Reduction and Growth Facility (PRGF)--Operational Issues, Prepared by the Policy Development and Review Department, 13th December 1999, <www.imf.org/external/np/pdr/prsp/poverty2.htm>

[19] World Development Movement, One size for all: A study of IMF and World Bank Poverty Reduction Strategies, September 2005.

[20] Nuria Molina and Javier Pereira, Critical Conditions: The IMF maintains its grip on low-income governments, Eurodad, April 2008.

[21] IMF Executive Directors and Voting Power, Last Updated: 23rd December 2011, <www.imf.org>

[22] Bretton Woods Project, ‘Less than meets the eye: IMF reform fails to revolutionise the institution', 9th November 2010.

[23] Yilmaz Akyüz, Reforming the IMF: Back to the Drawing Board, UNCTAD, No. 38, November 2005.

[24] María José Romero and Carlos Alonso Bedoya, ‘The Bank of the South: the search for an alternative to IFIs', Choike/Latindadd, 26th September 2008.

[25] The Group of Twenty, Leaders' Statement: The Pittsburgh Summit, G-20 Summit, Pittsburgh, 25th September 2009.

[26] Bretton Woods Project, ‘IMF's latest prescription: Cure the crisis with austerity', Update 71, 17th June 2010.

[27] Bretton Woods Project, ‘IMF's European austerity drive goes on', Update 76, 13th June 2011.

[28] Rick Rowden et al, Doing a decent job? IMF policies and decent work in times of crisis, SOLIDAR and Eurodad, October 2009.

[29] Jubilee Debt Campaign, ‘Private Debt, Public Pain: What the Third World Debt Crisis Means for Europe Today', December 2010.

[30] Walden Bello, Testimony of Walden Bello before Banking Oversight Subcommittee, Banking and Financial Services Committee, US House of Representatives, International Forum on Globalization, 21st April 1998, <www.ifg.org>

[31] For example, see the work of the International Forum on Globalisation, Focus on the Global South, and Committee for the Abolition of Third World Debt (CADTM).

[32] International Monetary Fund, ‘IMF Governors Formally Approve US$250 Billion General SDR Allocation', 13th August 2009.

[33] Ad Hoc Open Ended Working Group of the General Assembly, ‘G77 and China Position on Issues Related to the Outcome Document of the World Financial and Economic Crisis and its Impact on Development', United Nations, 23rd June 2010.

[34] United Nations, Report of the Commission of Experts of the President of the UN General Assembly on Reforms of the International Monetary and Financial System, 21st September 2009.

[35] Soren Ambrose and Bhumika Muchhala, op cit.

[36] Ibid, p. 7.

[37] International Monetary Fund, ‘IMF Executive Board Approves Limited Sales of Gold to Finance the Fund's New Income Model and to Boost Concessional Lending Capacity', 18th September 2009.

[38] The sale was approved on the recommendation of the Crocket Report. See Andrew Crockett, Final Report of the Committee to Study Sustainable Long-Term Financing of the IMF, International Monetary Fund, 31st January 2007.

[39] Jubilee USA, ‘IMF Should Use Excess Windfall Profits from Gold Sales to Cancel Debt for Poor Countries in Crisis', Background Paper on a Civil Society Proposal, January 2011.

[40] IMF, ‘IMF Executive Board Approves Distribution of US$1.1 Billion Gold Sales Profits to Facilitate Contributions to Support Concessional Lending to Low-Income Countries', Press Release No. 12/56, 24th February 2012

[41] Bretton Woods Project, ‘IMF gold sales money to fund loans', Update 80, 5th April 2012.

[42] Sony Kapoor, Paying for 100% Multilateral Debt Cancellation, op cit; Sony Kapoor, Mobilizing IMF Gold for Multilateral Debt Cancellation, pp. 92-100, op cit; Eurodad et al, Sell IMF gold to cancel the debt, op cit.

Image credit: Panos Images