Key points:

-

Carbon taxes can provide an incentive for consumers and industries to use fossil fuels more efficiently, help encourage the transition towards low-carbon energy technology, as well as raise significant funding for international climate finance.

-

There is currently no mechanism to account for the environmental cost of emissions in the shipping and aviation industries, which could raise additional revenue from a universal levy on international transportation. An additional option is a ticket levy on all international air travel, although this is not a carbon tax.

-

Altogether, at least $108bn per year could be raised from these carbon taxes and levies. This includes $75bn from national carbon taxes in OECD countries; $23bn from maritime and aviation taxes; and $10bn from a ticket levy on international flights.

-

Various types of carbon taxes have already been introduced in many countries, and support for their implementation continues to grow from many leading scientists, environmental groups and economists, particularly as an alternative to controversial emissions trading schemes.

As governments across the world fail to reduce their emissions to safe levels and climate change continues to spiral out of control, it is clear that the international community needs to take a more radical approach to combating global warming. Enforcing a strict cap on carbon use is arguably the most important step governments can take as part of a program of reforming patterns of energy consumption and decarbonising the global economy. As a more immediate option, civil society has long been calling on governments to implement a range of taxes on fossil fuels as an alternative to controversial emissions trading schemes that fail to address rising pollution levels.

Carbon taxes are levies placed on the carbon dioxide (CO2) emissions from burning fossil fuels that have the potential to incentivise energy efficiency, reduce greenhouse gas emissions, as well as encourage a long-term shift in the private sector towards investing in renewable energy sources. In recent years, the possibility of also using revenues from the levy to finance climate adaptation and mitigation programs has reinvigorated the possibility of its implementation - nationally, regionally and even globally.

For decades, green economists and campaigners have pointed out that the price of using fossil fuels, such as gas, oil or coal, does not accurately reflect the actual cost of its environmental, social or economic impacts. The artificially low price of these energy sources has encouraged our overreliance on them, exacerbated climate change and prevented the development of alternative forms of energy.

Carbon fees help to include the actual cost of these negative impacts (known as ‘externalities') in their price by taxing fossil fuels in proportion to how much CO2 they emit when used. Substantially increasing fuel prices in this way provides the necessary incentive for consumers and industries to use them more efficiently and emit fewer greenhouse gases (GHG). As renewable sources of energy become relatively more affordable, the tax could encourage industries to invest in the development of low carbon fuels and infrastructure, such as wind and solar. The Ministry of finance in the Canadian province of British Columbia, where a carbon tax was recently introduced, estimate that it will save three million tons of CO2 each year, equivalent to taking almost 800,000 cars off the road.[i]

It is generally agreed that carbon taxes work best when they are broad-based and increased incrementally over a number of years. Since most of the tax burden would ultimately fall on consumers, it is considered to be a regressive tax. To make the tax fairer, direct government intervention would be required to ensure that producers do not pass the costs on to consumers, which can be achieved through price regulations or by providing a financial dividend to citizens.[ii]

In light of the impending funding gap for climate change mitigation and adaptation, recent reports have gone beyond using the tax to reduce emissions and have focussed on how much additional revenue the tax could raise.[iii] Potential incomes are largely dependent on how widely the tax is implemented, the level of taxation introduced, and the proportion retained by the national governments responsible for collecting the revenues.

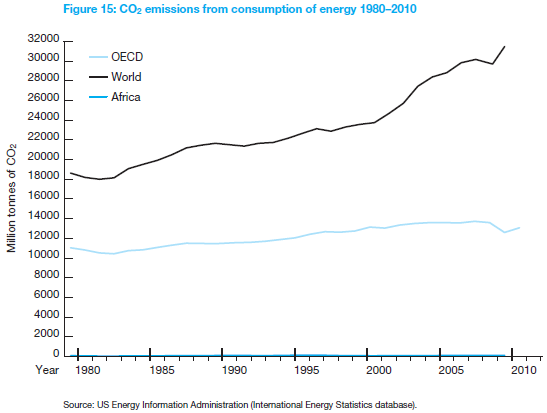

The tax is applied according to how much CO2 a given quantity of fossil fuel would emit when used, with higher taxes levied on more polluting fuels. If applied across all OECD countries, a tax of $25 per ton of CO2 emissions could raise $301bn.[iv] If national governments redistributed only a quarter of this revenue for international climate finance purposes, it would still raise over $75bn each year.[v] The impact on consumers would be minimal, however, as a tax at this rate might only increase the price of gasoline by less than 10 cents (US) per litre.[vi] However, there is nothing to prevent policymakers from pricing carbon at a much higher rate in order to generate more revenue.

Maritime and Aviation Fuel Taxes

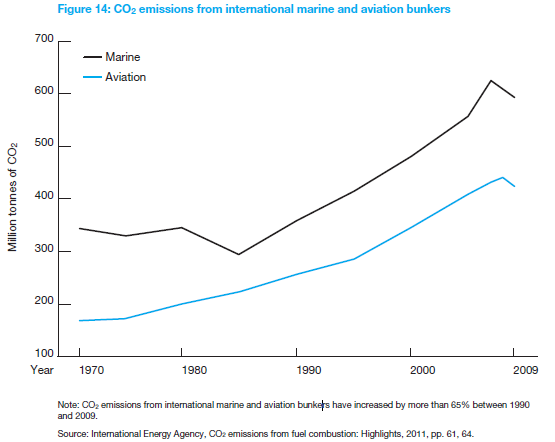

Due to the international nature of their activities, emissions from the shipping and aviation industries are not necessarily included in the emissions figures for individual countries, and are neither measured nor limited under the Kyoto Protocol. Currently there is no mechanism to account for the environmental cost of emissions from fossil fuel use in these sectors. Together, emissions from international shipping and aviation represented approximately 3.5% of world CO2 emissions in 2009 [see figure 1].[vii] These shares are expected to rise significantly over coming years with estimates suggesting that emissions from the two sectors could triple by 2050.[viii]

Like nationally collected carbon taxes, the imposition of a fuel levy on international transportation reflects the ‘polluter pays' principle and can raise significant funding for climate change. But shipping and aviation industry levies could also yield additional revenue for developing countries. In line with the principle of 'common but differentiated responsibility' [see note],[ix] a universal fuel levy on international transportation would have to include a rebate for developing countries. A recent report by the World Bank found that a globally-implemented levy based on a carbon price of $25 per ton of CO2 could raise $12bn a year from aviation and $26bn from shipping by 2020. Compensating developing countries for the economic harm they might suffer from such charges is estimated to require up to 40% of global revenues, leaving $23bn or more for climate finance or other uses.[x]

If combined with ticket levies on international air travel [see box], carbon taxes on OECD countries and the maritime and aviation industries alone could raise up to $108bn every year [see revenues section below] - significantly more than the amount required to finance the entire Green Climate Fund currently being established under the United Nations Framework Convention on Climate Change (UNFCCC) Cancun Accords (2010).[xi]

Carbon taxes are often presented as a favourable alternative to carbon trading, which is another market-based approach to delivering cuts in emissions from global energy use [see box]. Taxation is widely considered to offer more price stability and predictability, greater ease of control by governments, and a simpler instrument to implement than the highly complex and controversial carbon trading schemes that are currently in existence.[xii] Steadily increasing carbon fees on fossil fuels may also play a useful role in incentivising energy efficiency and reducing excessive energy consumption, as well as offering many related benefits such as reducing dependence on foreign oil, stimulating advances in low-carbon energy technology, and facilitating job growth in low-carbon energy and energy conservation industries.

In the longer term, however, carbon taxes are not a silver bullet that can solve the problem of climate change by themselves, and they can do little to address the way that fossil fuels are ‘locked in' to industrialised economies or the fundamental power dynamics inherent in current production and trade patterns.[xiii] As many environmental groups attest, the real solutions to climate change require massive investments in renewable energy in all countries and a significant reduction in fossil fuel energy consumption, particularly in the industrialised world.

How much revenue could be mobilised?

National carbon taxes applied to OECD countries

A tax of $25/ton of CO2 emissions applied across all OECD countries would raise $301bn each year.[xiv] Making only a quarter this available could raise almost $75bn each year for climate finance.[xv]

Maritime and aviation taxes

A levy of $25/ton of CO2 emissions applied across these industries could raise $38bn each year. Given the need to provide rebates for developing countries, it is feasible that at least $23bn of this revenue could be allocated to climate finance for developing countries each year.[xvi]

Ticket levy on international flights

A levy of $6 per economy ticket and $62 per business/first class ticket could raise up to $10bn annually [see box 16].[xvii]

Total potential revenue: $108bn each year.

Box 16: Taxing international air travel

An additional option is a ticket levy on all international air travel. While this is not a carbon tax and would not have a mitigation effect (as it has been proven not to impact the market in air travel), it does reflect the ‘polluter pays' principle common to carbon fee proposals. The ticket levy has the advantage of rapid implementation at minimal cost, and could raise significant revenue for climate finance.

A ticket levy on international aviation has significant international support from the least developed group of countries who continue to push for its introduction in international climate negotiations. The proposed International Air Passenger Adaptation Levy would simply be collected by airlines from their passengers at the point of sale, with some of the revenue returned to airlines for the costs of administering the system.

A version of the levy is already being successfully implemented in France, where all passengers leaving the country are charged a "solidarity contribution" (€1 for European flights, €4 for international flights, €10 for business/first class). The fee has enabled France to generate an extra €160 million (US$216) in conventional aid in 2009, of which 90% was dedicated to the UNITAID international purchasing facility aimed at combating major pandemic diseases in the developing world. According to a report by the UN Secretary-General's High-level Advisory Group on Climate Change Financing, a levy of $6 per economy ticket and $62 per business/first class ticket would raise up to $10bn annually.[xviii]

Time to act on climate taxes

With diminishing hopes for an effective post-Kyoto agreement and no significant reductions in global emissions on the cards, civil society is desperately calling for more effective action on climate change. There is now growing support for the role that carbon taxes can play in climate mitigation from many leading scientists, environmental groups, economists and high-profile figures including Al Gore and Nicholas Stern. NASA scientist James Hansen has also become a prominent advocate of a revenue-neutral carbon tax as an alternative to cap-and-trade and offset schemes, which he proposes should be collected from fossil-fuel companies at the point of first sale and distributed equitably to the public as a monthly ‘dividend' or ‘green check' so that families can afford the energy they need during the transition to a clean energy future.[xix]

While implementing legislation for a flat carbon tax across all energy sectors is difficult to achieve, various types of carbon fees have been introduced throughout the world, including several in Northern European countries such as Finland and Sweden. The Canadian province of British Columbia implemented a carbon tax in 2008, and Australia implemented the tax in the form of a ‘carbon price mechanism' in July 2012 - described as one of its biggest economic reforms in a decade, and the most comprehensive carbon price scheme outside of Europe.[xx] China is among a number of countries considering introducing the levy, and in the US - now the second largest emitter of CO2 after China - Members of Congress have also introduced several legislative proposals for pricing carbon in the 111th Congress.[xxi]

Fuel levies

A fuel levy would technically be much simpler to implement than other carbon taxes, and various international discussions have taken place to determine how to introduce them. The levy would be charged at all fuel bunkers in ports around the world, to be collected and redistributed by the international representative bodies for the maritime and aviation sectors - the International Maritime Organisation (IMO) and the International Civil Aviation Organisation (ICAO). Any legal barriers to the tax could easily be overcome with an international agreement under the UNFCCC negotiations. Universal implementation would ensure equal treatment of operators of all nationalities, while also making evasion difficult.

The EU recently implemented plans to levy emissions of most flights that land or depart from Europe from 1st January 2012 - a measure the airline industry and a large group of countries has fiercely resisted.[xxii] China in particular has strongly opposed the EU's move, claiming that it is unfair, illegal or both, and breaks away from the basic legal framework of the UNFCCC and Kyoto Protocol.[xxiii]Measures discussed by a group of nearly 30 countries opposing the carbon tax scheme, including the US, China and India, considered sanctions against European airlines or the opening up of a trade war.[xxiv] The International Air Transport Association also claimed that the EU's scheme may undermine a global solution to curb aviation's environmental damage.[xxv]

Funding international climate programs

Since the Cancun climate talks in 2010, various types of carbon taxes have been proposed by policymakers as innovative ways to finance climate change mitigation and adaptation in developing countries. The Government of Switzerland are among those who have been calling for carbon fees to be applied globally and collected by an independent agency, albeit at a much lower rate and with substantial rebates provided to low-income countries.[xxvi] While international agreement on how governments could implement these taxes universally remains an obstacle to progress, it may be more feasible for governments to act unilaterally and implement the tax on a national level.[xxvii] However, it remains imperative that a proportion of carbon tax revenues, whether collected nationally, regionally or globally, are directed to finance international climate programs such as the UN's ‘Green Climate Fund' for the most vulnerable nations.[xxviii]

Campaigners have a long way to go before the various ‘climate tax' options are acknowledged by policymakers to be viable alternatives to the highly flawed carbon trading schemes that currently monopolise the emission reduction debate. But with limited options and time for effective action fast running out, civil society must step up their advocacy for carbon taxes as an important policy tool for reducing climate change and financing mitigation and adaptation programs.

Box 17: False Solutions to Climate Change

The following text is taken directly from the booklet ‘Hoodwinked in the Hothouse: False Solutions to Climate Change' (Second Edition, Published July 2010), reproduced with kind permission from Carbon Trade Watch and Rising Tide North America. The complete publication is available at:www.carbontradewatch.org or www.risingtidenorthamerica.org

Part I: Cap and Trade

The practice of carbon trading was implemented by the Kyoto Protocol as a strategy for tackling climate change, while allowing business-as-usual in industries that profit most from the use of fossil fuels. Essentially, governments made carbon pollution a market commodity by issuing tradable pollution permits. As the theory goes, the amount of permits issued would decrease year by year and carbon emissions would be reduced correspondingly.

The world's largest cap and trade system is in Europe and it has been an unmitigated failure, beset by fraud and market manipulation. The market includes large industrial power stations, plants and factories, which comprise just under half of Europe's total CO2 emissions. Over 90% of permits are issued free of charge, yet some power companies have raised prices to "compensate" for the costs of the scheme, resulting in windfall profits expected to reach $80bn by 2012. At the same time, a majority of companies have received more permits than their actual emissions, leading to bargain-basement prices for the remaining permits and little incentive to limit emissions. To make matters worse, emissions monitoring is woefully inadequate: Nearly half the emission sites that purchase carbon credits in Europe are not satisfactorily monitored.

Proponents say these problems can be fixed, but there are more fundamental issues. With short-term reductions in carbon emissions relatively inexpensive in carbon trading markets, there is little incentive toward crucial long term changes and investments that will be needed to create a post-carbon economy. Furthermore, because cap and trade systems leave everything to the market, they can exacerbate pollution inequities. For example, the US sulfur dioxide trading market has led to increases in pollution in some low-income communities and communities of color as industries decide to concentrate pollution in areas with less rigorous environmental enforcement and lower "political costs."

Most troubling, cap and trade creates an experimental new system of private property rights. Corporate balance sheets and legal statutes record carbon permits as property in the same way government-issued patents or land grants are accounted for. When the most powerful actors in society are given additional property rights, their ability to shape our future is further entrenched. The vast majority of carbon trades are made by either energy producers seeking protection from fossil fuel and currency price fluctuations, or by specialist traders seeking speculative profit, rather than by companies concerned with meeting their "caps." Cap levels and trading rules are the product of endless lobbying by companies and countries trying to retain their high allowances.

Market analysts widely expect the carbon market will become the largest commodity market in history. At a time when poorly understood, experimental markets dominated by powerful interests have thrust millions of households into foreclosure, with the world in the worst global recession in decades, do we really want another opaque commodity trading market?

Europe intends to fill some of the holes in the system-for instance, by auctioning off some permits rather than just giving them away. The fact remains that carbon trading does not address rising pollution levels, it simply hands over a crisis to be played out in the marketplace.

Part II: Carbon Offsets

Carbon offsets are a trick designed to make it cheap and easy for polluting companies and countries to meet their emissions reductions requirements, or for individuals to assuage their guilt about their lifestyles. Instead of actually reducing pollution, they can pay for a carbon "reduction" project elsewhere. Offsets compound all of the problems of the cap and trade system-literally a license to pollute beyond the allotted "cap."

Nearly all of the technologies described in the booklet ‘Hoodwinked in the Hothouse: False Solutions to Climate Change' have received funding as offsets, their associated abuses enabled by-and enabling- coal, oil and gas companies who wish to carry on polluting. Carbon trading is the architecture supporting all other false solutions.

The Kyoto Protocol's "Clean Development Mechanism" (CDM) is the largest offset market in the world. As part of the Kyoto Protocol, it was established to allow wealthy polluting countries to "buy" cheaper carbon reductions in developing countries instead of making emission cuts at home. CDM is an attractive subsidy for big business, with reduction credits frequently being sold to support projects that would have happened anyway. The CDM is a billion dollar market and continues to expand into new methodologies and schemes.

This practice is anything but "clean"-it results in a net increase in pollution and displaces responsibility away from polluters. Countries and companies selling offsets have an incentive to over-report emissions reductions in order to obtain more credits to sell. This type of manipulation will be further encouraged by new speculative markets in carbon offsets, which have been pioneered by Goldman Sachs and other investment banks that have recently began marketing carbon-backed securities and subprime (junk) carbon bonds.

Offsetting encourages us to think we can buy our way out of climate catastrophe, but the reality is that offsets are a way for large polluters to continue dangerous levels of pollution within a new legal framework. Not only are the vast majority of offset projects socially and environmentally unjust, they distract us from the larger structural and social changes that need to happen to create a sustainable society.

Learn more and get involved

Carbon Tax Centre: Launched in 2007 to give voice to Americans who believe that taxing emissions of carbon dioxide - the primary greenhouse gas - is imperative to reduce global warming. See the newsletter ‘A Convenient Tax'. <www.carbontax.org>

Carbonfees.org: A citizens website on the problems in cap & trade progams and the benefits of carbon fees, including sample letters for campaigning and a 'whistleblower disclosure' section. <www.carbonfees.org>

Carbon Trade Watch: Centring its work on bottom-up community-led projects and campaigns, CTW aims to provide a durable body of research on climate change and environmental policies. <www.carbontradewatch.org>

CDM Watch: An initiative of international NGOs to provide an independent perspective on individual Clean Development Mechanism (CDM) projects and the political decision-making process affecting wider carbon market developments. <www.cdm-watch.org>

Friends of the Earth: See the FOE campaigning activities on global climate change, including the reports ‘A Dangerous Obsession (2009)', and ‘Clearing the Air (2010)'. <www.foei.org>

Global Policy Forum on Energy Taxes: Resources page of articles related to energy taxes which could raise revenues that can be earmarked for further investment in renewable energy sources. <www.globalpolicy.org/global-taxes/energy-taxes.html>

The International Energy Agency (IEA): See the World Energy Outlook publications and World Energy Statistics for the latest data on fossil fuel usage. <www.iea.org>

Report of the Secretary-General's High-level Advisory Group on Climate Change Financing: The final report by the United Nations on new, innovative and additional sources for the long-term financing of climate change mitigation and adaptation in developing countries. <www.un.org/wcm/content/site/climatechange/pages/financeadvisorygroup>

United Nations Framework Convention on Climate Change (UNFCCC): See the essential background pages for information on the international treaty and the Kyoto Protocol, including introductory and in-depth publications. <unfccc.int>

Notes

[i] British Columbia Ministry of Finance, Carbon tax, climate action tax credit both rise July 1, Press Release, 30th June 2011, <www2.news.gov.bc.ca>

[ii] Carbon Tax Centre, Introduction: What's a Carbon Tax?, retrieved October 2011 <www.carbontax.org>

[iii] See United Nations, Report of the Secretary-General's High-level Advisory Group on Climate Change Financing, New York, November 2010.

[iv] Note on calculation: In 2009, OECD countries had emissions of 12,045 million tonnes of emissions (International Energy Agency, CO2 Emissions From Fuel Combustion: Highlights, IEA Statistics, Paris: 2011, p. 46.) Multiply the carbon price ($25/ton) by the total emissions to determine revenue: $25/ton x 12045t = $301. This calculation is in line with the Report of the Secretary-General's High-level Advisory Group on Climate Change Financing, op cit, p. 48.

[v] Note on calculation: the 25% proportion was advocated for by Friends of the Earth (Sarah-Jayne Clifton, Clearing the Air: Moving on from carbon trading to real climate solutions, Friends of the Earth, December 2010), although it is possible for governments to allocate an even larger proportion of the revenue for climate finance.

[vi] The Province of British Columbia, Ministry of Finance Tax Schedule, REVISED: November 2010, Ministry of Finance Revenue Programs, retrieved Oct 2011, <www.fin.gov.bc.ca/rev.htm>

[vii] Note on calculation: In 2009, CO2 emissions from shipping reached 592.2 million tonnes, which represented 2.0% of total world CO2 emissions in 2009 (28,999.4mt). Emissions from aviation reached 423.4mt of CO2 in 2009, or 1.5% of total world emissions. See IEA, CO2 emissions from fuel combustion, op cit, p. 46.

[viii] World Wildlife Fund, International transport: turning an emissions problem into a finance opportunity, June 2011.

[ix] In The United Nations Framework Convention on Climate Change (adopted on the 9th May 1992) it was agreed that; 1. the largest share of historical and current global emissions of greenhouse gases originated in developed countries; 2. per capita emissions in developing countries are still relatively low; 3. the share of global emissions originating in developing countries will grow to meet social and development needs.

[x] Michael Keen et al, Market-Based Instruments for International Aviation and Shipping as a Source of Climate Finance, Policy Research Working Paper 5950, World Bank, January 2012, pp. 52-53. Note: This report extended the work of the High-Level Advisory Group on Climate Change Financing to the UN Secretary General, op cit.

[xi] Liane Schalatek, Designing - and Funding! - the new Green Climate Fund, 26th January 2011, <www.climateequity.org>

[xii] Sarah-Jayne Clifton, Clearing the Air: Moving on from carbon trading to real climate solutions, Friends of the Earth, December 2010, p. 26.

[xiii] Tamra Gilbertson and Oscar Reyes, Carbon Trading - How it Works and Why it Fails, Critical Currents no. 7, Dag Hammarskjöld Foundation, November 2009, see chapter 5.

[xiv] See reference 4.

[xv] See reference 5.

[xvi] Michael Keen et al, op cit, pp. 52-53.

[xvii] UNFCCC, International Air Passenger Adaptation Levy: A proposal by the Maldives on behalf of the Group of Least Developed Countries within the Bali Action Plan, 12th December 2008.

[xviii] Ibid.

[xix] See: People's Climate Stewardship / Carbon Fee and Dividend Act of 2010, Proposed by Dr James Hansen: Earth Day, 25th April 2010.

[xx] Further information about the Government's announcement of a carbon price and mechanism is available at <www.cleanenergyfuture.gov.au>

[xxi] Carbon Tax Centre, Bills, Legislative Proposals for Carbon Pricing in the 111th Congress, Accessed November 2011, <www.carbontax.org>

[xxii] The International Air Transport Association (IATA), ‘Industry Committed to Emissions Reductions - Europe Should Abandon Misguided ETS Plans', Press Release No. 46, 27th September 2011.

[xxiii] Martin Khor, ‘Trade War Looms Over EU's Tax On Airlines', South Bulletin 60, South Centre, 5th April 2012.

[xxiv] Fiona Harvey, ‘Sanctions threat to European airlines over emissions trading', The Guardian, 23rd February 2012.

[xxv] Gwyn Topham, ‘Airline industry: EU emissions trading scheme 'could risk trade war', Guardian, 11th June 2012.

[xxvi] Swiss Confederation, Global Solidarity in Financing Adaptation: A Swiss Proposal for a Funding Scheme, Federal Department of the Environment, Transport, Energy and Communications (DETEC), Berne, 11th December 2007.

[xxvii] Sarah-Jayne Clifton, A Dangerous Obsession: The Evidence Against Carbon Trading and the Real Solutions to Avoid a Climate Crunch, Friends of the Earth, November 2009, pp. 44-45.

[xxviii] For more information, see: United Nations Framework Convention on Climate Change,Transitional Committee for the design of the Green Climate Fund, Accessed October 2011, <www.unfccc.int>

Image credit: hoesim, flickr creative commons