If we recouped the annual global revenue losses due to multinational tax avoidance, we could literally eliminate extreme income poverty around the world by giving $2 a day to the 650 million people currently living under the international poverty line of $1.90 a day. By Alex Cobham for Truthout.

International tax rules have reached a crossroads. The reform program announced by the Organisation for Economic Co-operation and Development (OECD) this summer represents the last chance for the Organisation’s club of rich countries to find an approach that can curtail the rampant tax avoidance of multinational companies.

The reform program includes apportionment approaches that assess profits at the level of the multinational group, rather than individual entities, and then apportion it as tax base between countries of operation in proportion to the share of real economic activity in each.

The technical complexities of reform, however, are multiplied by political issues, with OECD member states now identified among the main procurers of profit shifting, at the expense of all others. Another failure on reform, however, would leave the Organisation struggling to maintain any claim of legitimacy.

The global financial crisis laid bare the extent to which international tax rules were failing to keep pace with the tax maneuvering of multinationals and their advisers, including the big four accounting firms: KPMG, Ernst & Young, Deloitte and PricewaterhouseCoopers.

Data on U.S. multinationals show that in the 1990s, between 5 to 10 percent of their global profits were being shifted. That is, those profits were declared for tax purposes in jurisdictions other than where the real economic activity took place. By the early 2010s, the phenomenon had exploded to encompass 25-30 percent of global profits.

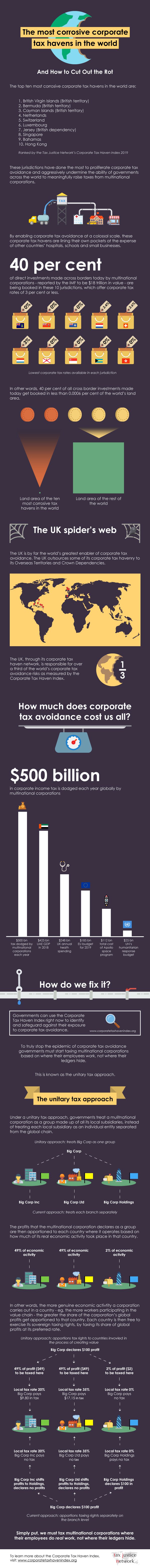

A range of research findings from academics and international organizations like the International Monetary Fund (IMF) put the annual global revenue losses due to multinational tax avoidance in a range between $200 billion and $600 billion. My organization, the Tax Justice Network, replicated the study by IMF researchers, which estimates the extent to which corporate tax havens depress the levels of taxable profit declared in the countries where multinationals’ real business is done. While the IMF puts the global losses at $600 billion, the Tax Justice Network uses a more robust dataset and reaches a more conservative global annual revenue loss figure of $500 billion — with lower income countries losing around $200 billion.

There is consensus that lower-income countries suffer losses equivalent to a substantially higher share of their current tax revenues, while OECD members, including the U.S., lose the greatest revenues in absolute terms. If we created a new country with a GDP made up of the $200 billion revenues stripped from lower-income countries, it would be about the 50th biggest economy in the world, between Egypt and New Zealand. For the full $500 billion, we could just about buy Facebook. Or, more usefully, we can literally eliminate extreme income poverty around the world by giving $2 a day to the 650 million people currently living under the international poverty line of $1.90 a day.

OECD members are also, however, the key drivers of profit shifting. The Tax Justice Network’s newly released Corporate Tax Haven Indexassesses jurisdictions on the extent to which their systems are designed to leech profits from elsewhere, including the lowest available rate of corporate income tax and the aggressiveness of tax treaty networks. This is then weighed according to each jurisdiction’s share of the global stock of foreign direct investment, for a combined ranking which reflects the importance of the tax avoidance risk posed.

The U.K. ranks 13th in the index, but its overseas territories occupy the top three places (the British Virgin Islands, Bermuda and Cayman Islands), and its crown dependencies (Jersey, Guernsey and the Isle of Man) 7th, 15th and 17th. Taken together, the U.K. network is the greatest enabler of avoidance globally.

The top six is rounded out by the Netherlands, Switzerland and Luxembourg. The analysis confirms earlier work that a handful of jurisdictions (including Singapore, ranked 8th, and Ireland, 11th) is responsible for the great bulk of revenue losses imposed on others.

But waiting for the OECD to fix international tax rules when major members benefit from their weakness may be optimistic to the point of foolishness. Still, there are some signs of progress. From 2013-2015, the OECD Base Erosion and Profit Shifting action plan made two important contributions. First, it provided an agreed-upon single goal: to reduce the misalignment between profits and the location of real economic activity. Second, it required country-by-country reporting from multinationals — data with which to monitor that misalignment.

The failure of the action plan to deliver meaningful change in the tax rules rested on the initial decision of OECD members to maintain the “arm’s length” principle: evaluating the taxable profits of individual companies within a multinational group separately, as if they were trading with each other as unrelated entities would.

Now, the OECD’s announced reform program will go beyond arm’s length. At the prompting of India and members of the G24 group of countries, the taxing rights of states would, for the first time, be determined by the location of multinationals’ employment and sales (and perhaps other factors).

This is, of course, the approach that is taken to corporate taxation within the U.S. and other countries, including Canada and Switzerland. But multinationals and their lobbyists, including the big four, have so far managed to prevent such progress internationally.

The OECD program does not guarantee that this option will be chosen, nor has it been decided whether the approach would apply to all profits of multinationals in all sectors of the economy or some narrower category.

But it is clear that the door is open, finally, to more radical reform. For the first time, the OECD has framed its work in terms of the distribution of taxing rights, recognizing that the problem is ultimately political rather than primarily technical.

Last May, a high-level summit in New York convened by the president of the UN General Assembly saw the strongest demands yet for tax issues to be moved to a United Nations forum. If lower-income countries are denied an effective voice in the OECD process, or if the results fail to ensure substantially greater alignment of profits with the location of real activity, then the pressure for UN policy setting is likely to become irresistible.

At the same time, the normalization of alternatives to the arm’s length principle, including unitary tax and formulary apportionment, may well see the spread of unilateral approaches.

The challenge for the OECD now is to deliver a set of international tax rules that sharply curtails the tax avoidance of multinational companies — at the expense of those OECD members that have benefited most from procuring profit shifting.

Trump’s Tax Cuts and Jobs Act has engineered a dramatic fall in U.S. corporate tax revenues, with no discernible increase in investment or benefits for labor. Seasonally adjusted annual corporate tax revenues have fallen by more than half since 2016 – bigger than any drop in U.S. history other than that due to the financial crisis in 2008-2009, and taking revenues below even that crisis level. This time, the economy is still growing, and the losses are a deliberate policy choice. Around 70 percent of the tax savings from the corporate rate cut went to the top fifth of the population, and more than a third to just the top 1 percent of households. Meanwhile, the latest findings from the Congressional Research Service show that any change in investment since the Act has been “relatively small and is not out of line with historical fluctuations,” while “ordinary workers had very little growth in wage rates.”

Progressive support for a global shift to unitary tax with apportionment based on the location of employment and sales could draw a line under the race to the bottom, with substantial benefits in the U.S. as well as in lower-income countries around the world.

The Tax Justice Network has created an infographic below highlighting the effects of corporate tax avoidance.

Alex Cobham is an economist and chief executive of the Tax Justice Network. Follow him on Twitter: @alexcobham.

Original source: Truthout